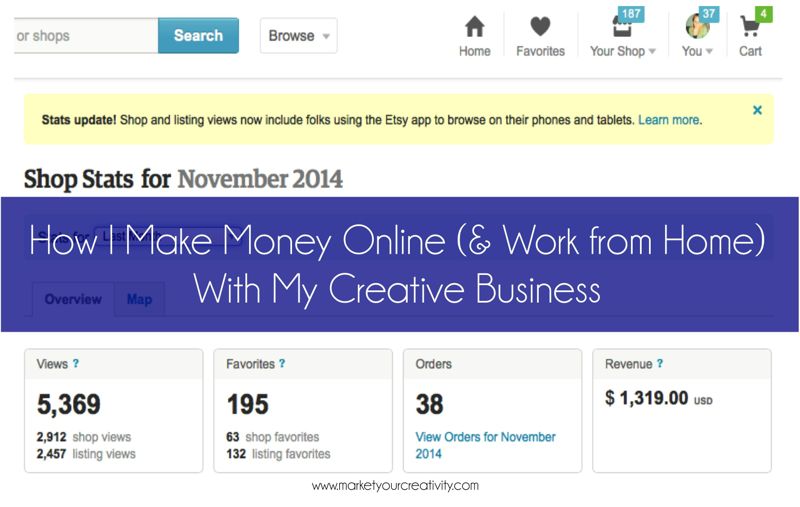

The November results are in! Since I can’t calculate December’s wages until the month’s end, this is officially the last income report of 2014. I couldn’t be more thrilled with the results, and in just a few days, I’ll be sharing what I’ve learned from tracking my profits all year + how you can apply my lessons to your own business. I’m also going to use that post to calculate my average hourly wage, and I’m so excited to see that number.

How I Spent My Working Hours

On to the income report! This year, I’ve shared how I spent my working hours each month and exactly how much I earn from those hours. Click here to read my theory on working less to achieve more.

Since reducing to four-hour workdays, I have completed the following tasks in 68 working hours, November 1-30 with 1 personal day and 2 holidays off:

The Luminaries Club (membership program): 8

Marketing Creativity posts (this blog): 21

Private coaching: 1

Energy Shop inventory: 12

Energy Shop packaging and handling: 14

2015 Movers and Makers Summit: 6

Inbox zero: 6

I had a nice rhythm between the Energy Shop and this blog in November, and with no major deadlines looming, I was able to enjoy my work at a casual pace. I have a goal to end the cycle of feast or famine in 2015, and November was the perfect model of steady work and steady pay.

Here’s How Much I Made This Month:

As you know, it’s full-disclosure 2014 for me. Not only do I break down how I spend my working hours each month, I’m also reporting exactly how much I profit from my creative business.

In November 2014, I earned a net income of: $2,161.31

I start almost every discussion on money or building a rewarding creative business with full disclosure that I believe a multi-faceted business is a must. Therefore, in each monthly report, I’m going to list the source of my income from highest- to lowest-paying for that period. November’s sources of income were:

1. Marketing Creativity’s programs and products, specifically The Luminaries Club and Your Best Year 2015

Creative Business vs. Traditional Workplace

I made this comparison in the first month’s report, and because I love breaking down the numbers (and proudly showing them to my husband ), I’m going to continue. By end year, I’ll be able to average out an official hourly wage for myself.

I calculate my wages every month, and then I do a little math. First off, minimum wage in my state is $7.25 per hour. Let’s say I went out looking and landed a really good job, doubling minimum wage at $14.50 per hour. Let’s even say that this job offered me flexible hours so that I was only ever working while my children were in school (35 hours per week).

Here’s what I made in November …

$2,161.31 / 68 hours = $31.78 per hour

That’s roughly $540.33 per 20-hour, work-at-home week (after taxes)

Vs. what I might make in the traditional workplace …

$14.50 x 35 hours = $507.50 per 35-hour week at a traditional job (before taxes)

For an estimated total of $1522.48 per month, $380.62 per week (after taxes)

I wasn’t sure if I was going to continue to share my income into 2015, but based on your overwhelming response (and support), I’ve decided to continue. Next year is my fifth year at this, and it’s no secret that I’m ready to make it happen and take my business to the next level. I’ll keep up with these reports as best I can.

Want more numbers?

See September + October’s hours + income

See August’s hours + income

See July’s hours + income

See June’s hours + income

See May’s hours + income

Hi Lisa,

I’m curious. When you figure out your hourly wages, do you take overhead (supplies) off after you figure your income? Or before you figure your profit?

This is all take-home pay (after expenses). The final profit represents what I have at the end of the month after expenses, taxes and supplies have been paid. With that final number (net income), I create an average hourly wage for the month.

Thanks for your question!

Thank you! I think I’m going to do this in 2015!